If you look around the world, we face unprecedented risks. The US-China trade war, Brexit, and slowing global growth are among the spot fires that could flare up and engulf portfolios.

The risks were obviously highlighted by the strong sell-off in markets at the end of 2018. Investors and advisers are no doubt looking to insure against those portfolio risks by using natural hedges like diversification and defensive assets.

But as you can see in the chart below, two big market events in recent memory – the 2000 tech wreck and the 2008 global financial crisis (GFC) – highlighted the limitations of diversification.

Source: Bloomberg, AMP Capital 2017

Bonds were meant to provide a ballast against falling equities. But just when we needed protection the most, both bonds and equities fell at the same time (positive correlation). It was as if we’d bought insurance for our house and the insurer didn’t pay up.

In this risky market environment, therefore, in our view, investors and advisers need to look beyond diversification and defensive assets, and consider other forms of portfolio insurance and protection, such as options. But it is also our view that they need to learn how to use those options properly, so they protect portfolios but don’t drag down performance.

A simple contract

Options may seem complex, but essentially, they’re a contract that is sold by an option ‘writer’ to an option ‘holder’. That contract gives the holder the right (but not the obligation) to buy or sell a security, such as shares, at an agreed price on or before a specified date.

A ‘call’ option gives the holder the right to buy the underlying security; a ‘put’ option gives the holder the right to sell the underlying security.

You can limit your trading to options themselves; you don’t have to trade the underlying security. If the underlying shares fall, for example, your put options become more valuable.

But like any insurance, there is a cost involved. The holder must pay the option seller a ‘premium’.

Protection from puts

In our view, put options are a great way to provide protection against market falls.

Buying protective put options in our view hold similar traits to buying classic insurance – you pay a premium upfront and it pays a positive return when the market declines.

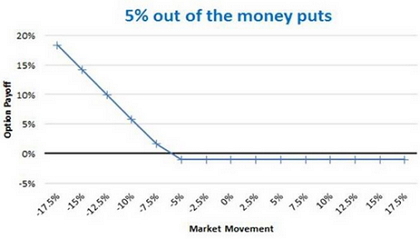

Source: Bloomberg, AMP Capital 2017

The put contract illustrated in the chart above has a strike price that is 5% below the market level. If the market falls by 10%, on the basis of the graph above, you will get a 6%return. The premium is 1.5%. If the market goes up or falls less than 5%, the option will expire worthless and you lose the premium.

The cost of options

Consumers buy insurance on their houses all the time. Similarly, consumers could also hold protective puts to protect portfolios.

However, because options cost money (the premium you pay to the option seller) they can drag on performance.

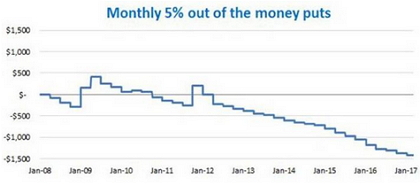

Source: Bloomberg, AMP Capital 2017

In the chart above, you can see the impact on a notional $10,000 of rolling put options at 5% below the money on the S&P500 in the US. There were positive payoffs to the left towards the GFC. But, generally, they are a drag on performance.

In our view, most investors and clients are in accumulation phase. They can handle short-term volatility, but we would say that most don’t want this drag on performance.

Prudent protection

The good news is that by using options selectively and dynamically, in our view, you can get portfolio protection without major performance drag.

There are three cost-effective ways to use options according to our analysis.

1. When it’s time

The first method is to only use options when your process or methodology says to reduce risk. For example, AMP Capital uses a Sentiment Score for its dynamic asset allocation (DAA) process, which informs us when to use options.

2. When they’re cheap

Another is to buy options when they are cheap. Premiums you pay for options change depending on what the market expects volatility will be. If the market expects higher volatility in the future, people buy more options which pushes their price up. The VIX index measures the implied level of volatility. If the VIX is low, options are cheap.

3. Other markets

Another way to keep costs low is to buy options in countries outside the US. Put options are expensive in the US. Regulations give insurance companies a big incentive to buy put options on market exposures, mostly the S&P500. That pushes up the price of put options. So, it may be beneficial to look at other markets, such as Europe and China, to buy protective puts.

Successful protection again presidential uncertainty

At AMP Capital we have successfully used options to protect against worrying market events.

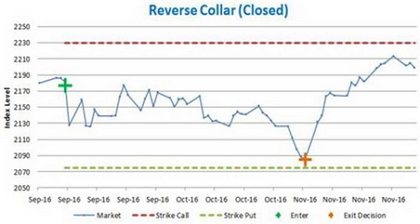

In September 2016, for example, we were particularly concerned about the US Presidential election triggering a market correction. Our DAA process also showed added risks from record low yields and high valuations in the S&P500.

So, for relevant portfolios we entered into a more complex options strategy, called a ‘reverse collar’ to protect against a possible correction.*

Source: Bloomberg, AMP Capital 2017

As shown in the chart above, we entered the position in early September, a good time. The market continued to be volatile along with the polling of the candidates. The market fell almost 5 per cent (close to the maximum payoff) and we exited the position when most of the potential gain from the strategy had been captured.

This example also highlights one of our key rules: each option must have pre-defined exit triggers, so we crystallise the benefit (or loss) in a disciplined manner.

Incorporating options into strategies and decisions

Portfolios that hold different types of assets, such as multi-asset funds, obviously have an inherent level of risk protection because they have a diversified range of assets.

But as we’ve seen, diversification doesn’t always deliver portfolio protection, particularly during extreme market events. Sometimes we need to turn to other forms of insurance and protection, such as options.

With the world facing significant geopolitical, economic and market risks, in our view advisers and investors should be considering incorporating options as an insurance strategy.

It is also our view that advisers and investors should also be seeking out investment managers who have the skills to use options in a cost-effective and disciplined manner so they can maximise protection and minimise performance drag.

If you would like to discuss any of the issues raised in this article, please call on Ph: (03) 9557 1057 or email WE_CARE@TBAFINANCIAL.COM.AU.

*A reverse collar is selling (short/writing) a put option and buying (long) the call option on the same index. At the same time, to cover any negative market movement and therefore the short put, we sell the same face value of the contracts short, with futures contracts in the S&P500 market.

A reverse collar takes advantage of skew in the US options market. Because of the previously mentioned insurance regulations, puts are more expensive than calls. The skew means we get protection (positive payoff) for the first 5 per cent of the market decline. And we only give up around 2.3 per cent of the upside if the market rallies.

Author: Heath Palos, Portfolio Manager, Multi-Asset Group

Source: AMP Capital 17 June 2019

Important notes: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (AMP Capital) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.

This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.