Introduction

It’s four years since the COVID lockdowns started. The pandemic ended when it morphed into the less deadly Omicron variant in late 2021, but just as a sound can reverberate around a room the effects of the pandemic continue to reverberate in economies. Putting aside the long-term health impacts this note looks at 7 key lasting economic impacts.

#1 Bigger government and more public debt

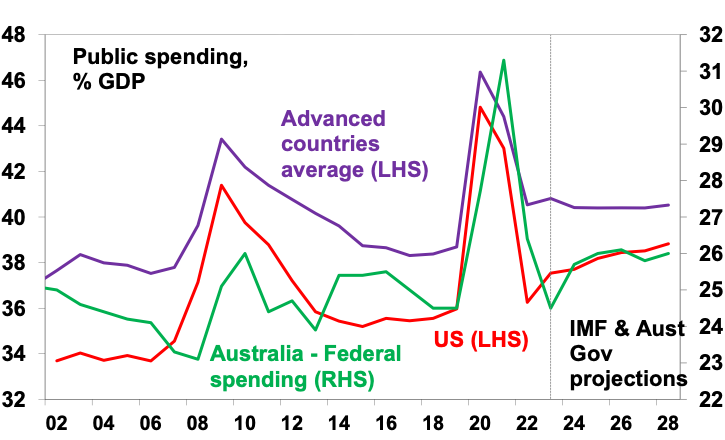

The malaise of the 1970s ushered in “smaller” government in the 1980s in the Thatcher, Reagan, Hawke and Keating era. But the political pendulum started to swing back to “bigger” government after the GFC & COVID has given it another push. Memories of the problems of high government intervention in the 1970s have faded and there is rising support for the view that government is the solution to most problems – via regulation, taxes, spending or education campaigns. The pandemic added to support for “bigger” government: by showcasing the power of government to protect households and businesses from shocks; enhancing perceptions of inequality; and adding support to the view that governments should ensure supply chains by bringing production back home. It’s combining with a desire for governments to pick & subsidise clean energy “winners”.

Public spending as a share of GDP

Source: IMF, Australian Government, AMP

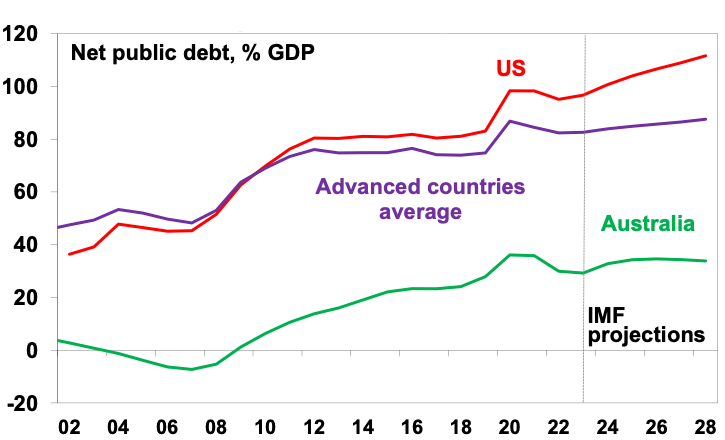

IMF projections for government spending in advanced countries show it settling nearly 2% of GDP higher than pre-COVID levels. The success of governments in protecting households from the worst of the pandemic has also reinforced expectations they would do the same in the next crisis. The pandemic ushered in even bigger public debt just as the GFC did. While high inflation helped lower debt to GDP ratios in 2022 it’s settling at higher levels than pre-pandemic.

Net public debt as a share of GDP

Source: IMF, AMP

Implications – While there may initially be a feel good factor, the long-term outcome of “bigger” government is likely to be less productive economies, lower than otherwise living standards and less personal freedom. It will take time before this becomes apparent though. Meanwhile, higher public debt means: less flexibility to respond with fiscal stimulus to a crisis; a greater incentive for politicians to inflate their way out; and interest payments being a high share of tax revenue.

#2 Tighter labour markets and faster wages growth

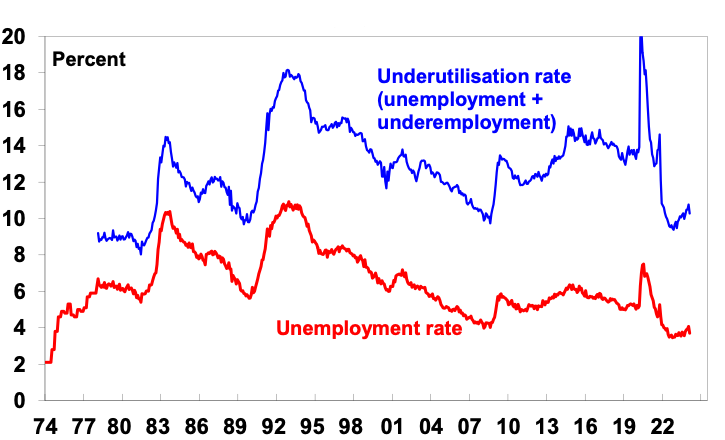

In the pre-pandemic years, wages growth was relatively low, & a key driver was high levels of underemployment, particularly evident in Australia. After the pandemic, labour markets have tightened reflecting the rebound in demand post pandemic, lower participation rates in some countries and a degree of labour hoarding as labour shortages made companies reluctant to let workers go. As a result, wages growth increased, possibly breaking the pre-pandemic malaise of weak wages growth.

Australia – unemployment & underutilisation

Source: ABS, AMP

Implications – Tighter labour markets run the risk that wages growth exceeds levels consistent with 2 to 3% inflation.

#3 Reduced globalisation/more geopolitical tensions

A backlash against globalisation became evident last decade in the rise of Trump, Brexit and populist leaders pushing a nationalist gender when the benefits of free trade were being questioned. Also, geopolitical tensions were on the rise with the relative decline of the US and faith in liberal democracies waning resulting in a shift from a unipolar world dominated by the US, to a multipolar world as regional powers (Russia, Iran, Saudi Arabia and notably China) flexed their muscles. The pandemic inflamed both: with supply side disruptions adding to pressure for the onshoring of production; conflict over the source of and management of coronavirus; it heightened tensions between the west and China; and it appears to have added to nationalism and populism. So, the days of global free trade agreements and falling defence spending seem long gone for now. Rather we are seeing more protectionism (eg with subsidies and regulation favouring local production) and increased defence spending.

Implications – Reduced globalisation risks leading to reduced potential economic growth for the emerging world and reduced productivity if supply chains are managed on other than economic grounds. And combined with increased geopolitical tensions resulting in more defence spending it could result in a more inflation prone world than was the case.

#4 Higher prices, inflation and interest rates

A big downside of the pandemic support programs was the surge in inflation. The combination of massive money printing along with a big increase in government payments to households (eg, Job Keeper) resulted in a massive boost to spending once lockdowns were lifted which combined with supply chain disruptions, also flowing from the pandemic, to cause a surge in inflation. Inflation is now starting to come under control as the monetary easing and spending boost has been reversed and supply has improved again but the pandemic has likely ushered in a more inflation prone world by: boosting “bigger” government; adding to a reversal in globalisation; and adding to geopolitical tensions. All of which combine with aging populations to potentially result in more inflation.

Implications – Higher inflation than seen pre-pandemic means higher than otherwise interest rates over the medium term which reduces the upside potential for growth assets like shares and property.

#5 Worse housing affordability

At the start of the pandemic, it was thought the economic downturn and higher unemployment and a freeze in immigration would cause a collapse in home prices and they did initially fall. But not by much as it was quickly turned around by policy measures to support household income, allow a pause in mortgage payments and slash interest rates and mortgage rates to record lows. What’s more the lockdowns and working from home drove increased demand for houses over units and interest in smaller cities and regional locations. As a result, Australian home prices surged to record levels. Meanwhile the impact of higher interest rates in the last two years on home prices was swamped by housing shortages as immigration surged in a catch up. The end result is now record low levels of housing affordability for buyers (who are hit by a double whammy of higher prices relative to incomes – see the next chart – and higher mortgages rates) and renters (who have seen surging rents).

Ratio of home prices to wags and incomes

Source: ABS, CoreLogic, AMP

Implications – Ever worse housing affordability means ongoing intergenerational inequality and even higher household debt.

#6 Working from home likely here to stay

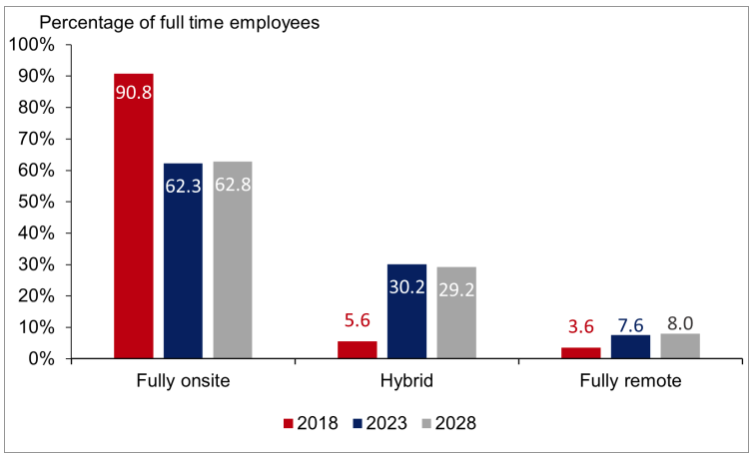

While there has been a return to the office, for many its only two or three days a week. Basically, the lockdowns resulted in a step jump towards working from home (WFH). A UK study of over 2000 firms is indicative. It showed that while around 90.8% of employees were fully onsite in 2018, last year this had fallen to 62.3%, with 30.2% with hybrid (working in the office and at home) arrangements. Similarly, the ABS found 37% of employed people in Australia regularly worked from home. Of course, this masks a huge range with industries with a high proportion of computer-based workers having more hours working at home. And firms expect this to remain the case. There are huge benefits to physically working together around culture, collaboration, idea generation and learning but there are also benefits to working from home with no commute time, greater focus, less damage to the environment, better life balance and for companies – lower costs, more diverse workforces and happier staff. So the ideal is probably a hybrid model. The proportion of workers in a hybrid model may even rise as new firms are quicker to embrace WFH.

Working arrangements for UK employees

Source: K Shah, and others, Managers say working from home here to stay, CEPR

Implications – Less office space demand as leases expire resulting in higher vacancy rates/lower rents, more people living in cities as vacated office space is converted and reinvigorated life in suburbs and regions.

#7 Faster embrace of technology

Lockdowns dramatically accelerated the move to a digital world. Everyone was forced to embrace new online ways of doing things. Many have now embraced online retail, working from home and virtual meetings. It may be argued that this fuller embrace of technology will enable the full productivity enhancing potential of technology to be unleased. The rapid adoption of AI will likely help.

Implications – This has meant a faster embrace of online retailing (up from 7% of retailing pre-pandemic to around 11%) at the expense of traditional retailing, virtual meeting attendance becoming the norm for many (even in the office) and business travel settling at a lower level.

Concluding comments

Perhaps the biggest impact is that the pandemic related stimulus broke the back of the ultra-low inflation seen pre-pandemic. Together with bigger government and reduced globalisation, this means a more inflation-prone world. So, a return to pre-pandemic ultra-low inflation and interest rates looks unlikely. It’s not all negative though – apart from the faster technology uptake, the global and Australian economies have come through the last four years in far better shape than might have been imagined at the start of the lockdowns!

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital March 2024

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.